All Categories

Featured

Table of Contents

Section 691(c)( 1) offers that a person who consists of an amount of IRD in gross earnings under 691(a) is enabled as a reduction, for the very same taxed year, a portion of the inheritance tax paid because the inclusion of that IRD in the decedent's gross estate. Normally, the quantity of the reduction is determined utilizing inheritance tax worths, and is the quantity that births the very same proportion to the inheritance tax attributable to the internet value of all IRD things included in the decedent's gross estate as the worth of the IRD consisted of in that individual's gross earnings for that taxable year births to the worth of all IRD items included in the decedent's gross estate.

Rev. Rul., 1979-2 C.B. 292, resolves a scenario in which the owner-annuitant acquisitions a deferred variable annuity contract that supplies that if the owner passes away prior to the annuity beginning day, the named recipient might choose to receive the present accumulated worth of the agreement either in the kind of an annuity or a lump-sum settlement.

Rul. 79-335 ends that, for functions of 1014, the contract is an annuity explained in 72 (as after that in impact), and consequently obtains no basis change because the proprietor's fatality because it is governed by the annuity exception of 1014(b)( 9 )(A). If the recipient elects a lump-sum settlement, the unwanted of the quantity got over the amount of consideration paid by the decedent is includable in the beneficiary's gross income.

Rul (Annuity death benefits). 79-335 concludes that the annuity exemption in 1014(b)( 9 )(A) relates to the contract explained because judgment, it does not particularly attend to whether amounts gotten by a recipient under a postponed annuity contract in excess of the owner-annuitant's financial investment in the agreement would go through 691 and 1014(c). Nonetheless, had the owner-annuitant surrendered the contract and got the quantities over of the owner-annuitant's investment in the agreement, those amounts would certainly have been earnings to the owner-annuitant under 72(e).

Do you pay taxes on inherited Annuity Payouts

Furthermore, in the here and now case, had A gave up the contract and obtained the amounts at concern, those amounts would certainly have been earnings to A under 72(e) to the level they surpassed A's financial investment in the agreement. Accordingly, amounts that B gets that exceed A's investment in the contract are IRD under 691(a).

Rul. 79-335, those quantities are includible in B's gross earnings and B does not get a basis modification in the contract. B will certainly be entitled to a deduction under 691(c) if estate tax was due by reason of A's fatality. The outcome would coincide whether B receives the survivor benefit in a round figure or as routine payments.

DRAFTING Details The principal author of this income judgment is Bradford R.

Are Annuity Income Riders death benefits taxable

Q. How are just how taxed as tired inheritance? Is there a difference if I inherit it directly or if it goes to a trust fund for which I'm the beneficiary? This is a great concern, but it's the kind you need to take to an estate planning attorney who recognizes the details of your circumstance.

For example, what is the partnership in between the deceased proprietor of the annuity and you, the recipient? What type of annuity is this? Are you asking about income, estate or estate tax? Then we have your curveball question regarding whether the outcome is any type of different if the inheritance is with a trust fund or outright.

Let's begin with the New Jacket and government estate tax obligation repercussions of inheriting an annuity. We'll presume the annuity is a non-qualified annuity, which indicates it's not component of an IRA or other professional retirement. Botwinick said this annuity would be included to the taxed estate for New Jersey and government estate tax obligation objectives at its date of fatality value.

Retirement Annuities inheritance tax rules

person partner surpasses $2 million. This is called the exemption.Any quantity passing to a united state person spouse will be entirely excluded from New Jersey estate tax obligations, and if the owner of the annuity lives throughout of 2017, after that there will be no New Jacket inheritance tax on any amount because the estate tax is set up for repeal starting on Jan. Then there are government inheritance tax.

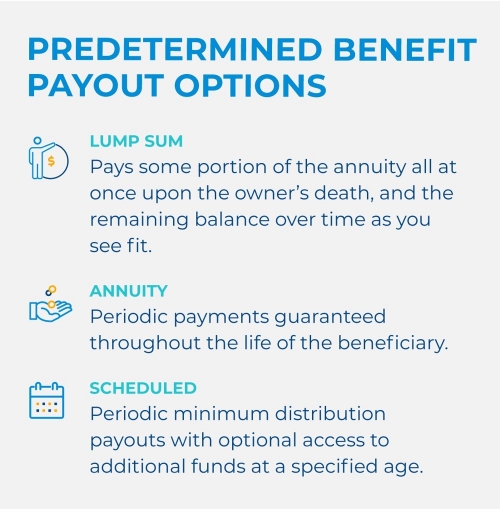

"Currently, earnings taxes.Again, we're assuming this annuity is a non-qualified annuity. If estate taxes are paid as a result of the incorporation of the annuity in the taxed estate, the beneficiary might be qualified to a reduction for inherited revenue in respect of a decedent, he stated. Beneficiaries have numerous options to think about when picking just how to receive money from an inherited annuity.

Table of Contents

Latest Posts

Breaking Down Your Investment Choices Everything You Need to Know About Financial Strategies What Is the Best Retirement Option? Advantages and Disadvantages of Different Retirement Plans Why Choosing

Breaking Down Fixed Annuity Or Variable Annuity Everything You Need to Know About Financial Strategies What Is What Is A Variable Annuity Vs A Fixed Annuity? Features of Variable Vs Fixed Annuity Why

Exploring What Is A Variable Annuity Vs A Fixed Annuity Everything You Need to Know About Financial Strategies Breaking Down the Basics of Variable Vs Fixed Annuity Benefits of Choosing the Right Fina

More

Latest Posts